This feature is the first of “The Business Toolbox” series, which takes an in-depth look at business decisions that shape the construction industry.

Winning new work is critical to a construction company’s survival, and the key to prevailing over competitors often comes down to providing the best cost estimate on which a bid is typically based. But even contractors that negotiate work with repeat clients must be able to justify their figures and make sure they are in line with the latest market pricing.

Trying to put together a solid estimate without all necessary information is difficult, if not impossible, according to contractors. Being able to access the project drawings, specifications and other pertinent data not only ensures accuracy but usually impacts the bottom line as well.

“When there are more periods than question marks,” said Tyler Isgett, senior pre-construction manager at New South Construction in Atlanta, “the cost of construction goes down.” This is because if contractors aren’t able to adequately define an aspect of the work, they typically add contingencies or allowances to compensate for what that work might entail. “When people don’t know what it is, they throw money at it,” he said.

The same holds true for subcontractors, who are usually an extra step away from the owner and often have to wrangle all the necessary information through the general contractor.

Once a contractor has all the relevant project documents, said Walter Volpe, chief estimator at Boston-area Gaston Electrical, it’s up to the company to determine, for example, if there are any gaps or if there are any local laws or codes that could alter the scope of work.

If contractors believe they don’t have all the information, it’s important to note those items in the estimate so that they don’t end up having to perform work despite not having accounted for it in their final number.

Look to the past

Historical data can help estimators put together a winning bid, but it takes a lot of effort to turn old project information into a useful tool. And how contractors use pricing and other data from previous bids varies.

“[Historical data] is extremely important,” Isgett said. New South looks at the data in combination with other factors to help guide budgets on future projects and to verify the accuracy of a current bid.

Gaston never uses historical data to compile estimates, Volpe said. Instead, that information is used as a pricing “reality check,” or as a way to fill gaps in information about some element of the work.

Get construction news like this in your inbox daily. Subscribe to Construction Dive:

But being able to have complete historical information comes at a price. “It becomes a burden, and it’s usually the last thing on your list when you finalize a project,” Isgett said. The requisite documents and information, he said, can be found in several software solutions, so it takes a lot of time to dig, find and then deposit it into a centralized location. Isgett has found that the solution often lies in dedicating one person, pretty much on a daily basis, to making sure the data is updated and there are no missing pieces.

There’s software for that

There are many construction estimating software systems, from simple to complex. Brian Jones, chief operating officer at Kentucky-based Gray Construction, said the company incorporates Sage Estimating into its bid prep toolbox, as does New South. Gaston said it gets the most use out of Accubid. Gaston and Gray also use On-Screen Takeoff, which eliminates the errors that come with manual takeoffs.

However, these programs only scratch the surface of what’s out there, and each company has to wade through the possibilities and figure out which software tool is the best fit. Chances are a contractor that has shifted into digital mode is already using estimating software. But for those who are just starting out with estimating programs, Jones said to keep it simple. Even Microsoft Excel, he said, can be helpful in tracking unit rates and other costs.

Volpe, however, said software is an investment, and suggested that contractors spend as much money as their budget allows on a system from an established vendor.

Working with subs and suppliers

For general contractors that outsource work, subcontractor participation in the estimating process is vital.

Isgett said New South requires subcontractors to submit estimates on a pre-configured, scope-of-work form that breaks down the project by line item. This way, the estimating team at New South can evaluate each bid side by side and make sure each subcontractor has all the same elements in their proposals.

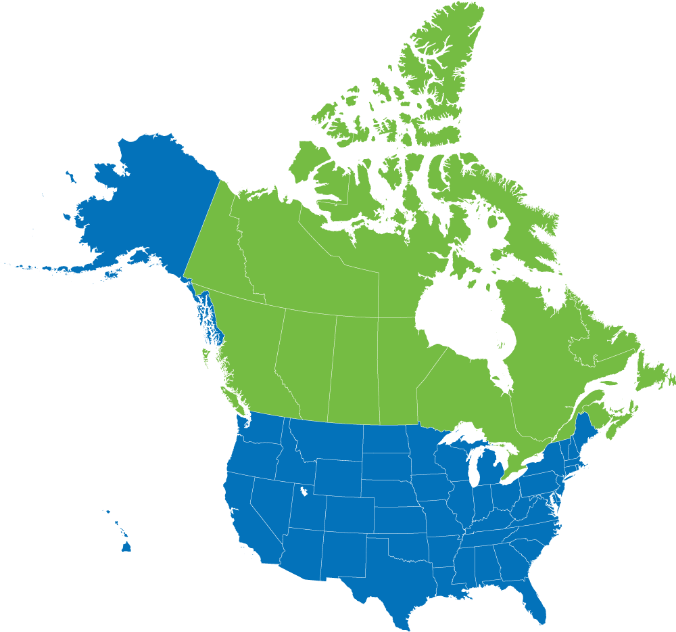

“We have thousands of subs that we invite to participate in projects,” Jones said. Gray’s jobs range from $150,000 retail projects to $300 million manufacturing complexes at job sites all over the U.S., so the subcontractors they work with could be the same repeat firms for decades, or brand new partners. These relationships, Jones said, not only provide a source for job pricing but ensure a stream of labor in a time when the skilled trade shortage is creating a lot of industry stress.

And subcontractor relationships need special attention, especially when it comes to the buyout process.

Some general contractors have looked at the post-award period as a chance to shop the low bid to other subcontractors or even try to get them to lower their prices in exchange for winning a contract. However, Jones said, that behavior is a thing of the past. Instead, Gray said that “profit preservation and optimization,” is the result of a keen evaluation of the project numbers carried out with all due respect to the subcontractor’s time and effort.

Have a fresh set of eyes

In the course of preparing an estimate, it’s important to have a process that guarantees several sets of eyes have evaluated it before it is submitted to the owner.

At New South, Isgett said, there is a pre-construction lead that checks the numbers of those assigned to put together a price for specific trades. The vice president of construction then looks at the overall estimate to make sure the team is on the right track. Company experts are also brought in to check for missing items or unrealistic figures. For example, an airport project will get the once-over from someone in the company who has worked on airport projects for 20 years.

Gaston’s process is a little more streamlined, but Volpe said no bid goes out the door without at least two individuals reviewing it for accuracy, regardless of whether it was put together by an intern or a company principal.

What the customer wants

What are some of the key things to remember when putting together an estimate?

For Jones, it’s being able to ascertain what’s most important to the customer and then tailoring the estimate to meet those needs in an effort to “really give the customers what they want.”

Isgett said it’s all about risk. “Evaluate and cover your risk,” he said. “Analyze it and put a cost to it.”

At Gaston, having a complete set of accurate bid documents is key to a solid, winning bid. “When documents are incomplete and contractors are required to fill holes, the outcome … may not be what the client envisions,” Volpe said. “A good set of construction documents makes sure the team is on the same page.”

STAY UP-TO-DATE!

Subscribe to receive our newsletters with insights and tips from industry experts.

RECENT ARTICLES

The Ultimate Guide to Finding Large Commercial Construction Project Leads (2025 Edition)

This 2025 guide breaks down the most effective strategies, tools, and platforms for finding commercial construction project leads. Whether you’re looking to diversify your project portfolio, expand into new regions, or scale your operations, this resource is your starting point.

Why Use a Construction Lead Generation Service? (Benefits for Large-Scale Projects)

If you're a contractor, supplier, or service provider looking to land more large-scale commercial jobs, chances are you've tried everything—referrals, bid portals, cold calls, and even LinkedIn messages. While those tactics still hold some value, they’re no longer enough to compete at scale.

Optimizing Your Online Presence to Attract Commercial Construction Leads

Whether you're a general contractor, subcontractor, supplier, or service provider, your online presence plays a critical role in attracting large commercial construction leads.