The Construction Turning Point: What You Need to Know About Rate Cuts and 2026 Growth

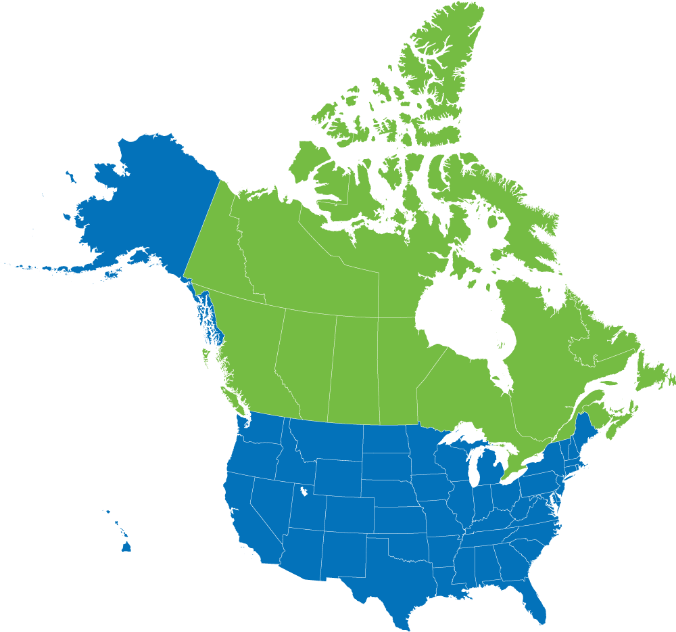

By Construct-A-Lead — your source for large commercial construction leads across the U.S. and Canada

The Quick Take

Interest rates are finally easing—slowly, but meaningfully—and that’s creating new momentum across the commercial construction industry.

U.S. rates are trending down. After the Federal Reserve’s September rate cut, the federal funds rate now sits around 4.00%–4.25%, with another small reduction expected later this fall if inflation continues to ease. Even modest cuts can have a big impact—unlocking financing, reviving stalled projects, and improving project feasibility.

Canada is following suit. The Bank of Canada lowered its overnight rate to 2.50% in September and is signaling a gradual path toward further reductions. This shift is expected to boost public-sector and institutional projects, particularly in infrastructure, healthcare, and education.

Design activity is stabilizing. The Architecture Billings Index (ABI) remains just below the growth threshold of 50, showing early signs of recovery.

- Midwest: 49.8 — nearly back to growth territory

- South: 47.9 — the most resilient region

- Northeast: 43.8 — owners remain selective

- West: 40.6 — office and mixed-use still lag

Capital is moving again. Investment activity rose about 13% in the first half of 2025, with a September surge signaling that buyers and lenders are re-engaging. It’s a clear shift from hesitation to opportunity, especially in industrial, healthcare, and data center construction.

Where Rates Sit Now—and Why That Matters on the Jobsite

United States

The Fed’s latest rate cut brought borrowing costs down slightly, and while more cuts will likely come gradually, the message is clear: financing is becoming more accessible. Even a 25–50 basis point drop can make a major difference in project budgets, tighten bid spreads, and revive paused developments.

The Fed’s Senior Loan Officer Survey shows lending standards are still cautious but slowly improving. With debt service ratios easing and refinance math looking better, more projects are expected to move forward through late 2025 and into 2026.

Canada

North of the border, rate reductions are already showing an effect. Non-residential construction investment ticked up slightly to C$6.8 billion in August, with growth in commercial and institutional sectors offsetting small industrial declines. As rates continue to ease, expect to see infrastructure and civic projects ramp up sooner than in the U.S. cycle.

What the Pipeline Is Telling Us

Across North America, design activity is stabilizing, setting the stage for a broader construction rebound. While billings remain just below 50 on the ABI, the Midwest and South are near breakeven, showing particular strength in industrial and healthcare development.

Owners in the Northeast and West remain cautious—especially with office and mixed-use projects—but the data suggests a return to steady demand as borrowing costs decline and investor confidence improves.

Capital Flow & RFPs: The Early-Cycle Shift

Money is starting to move again. U.S. commercial real estate deal volume climbed roughly 13% year-over-year in the first half of 2025, with September marking a notable uptick. More trades mean more price clarity—and more projects moving from “wait” to “go.”

Lenders are cautiously reopening their books as well, with slightly higher loan-to-value ratios and renewed competition for quality projects. While credit standards remain disciplined, financing is no longer frozen, and owners are dusting off plans that were shelved during the high-rate period.

For contractors, suppliers, and manufacturers, this means RFPs are expected to reappear first in the industrial, mission-critical, and healthcare sectors, followed by tenant improvements and mid-sized private builds as borrowing costs edge down.

What Happens When Rates Drop

When rates fall, construction usually follows. Here’s how that cycle typically unfolds:

- Financing improves: More private projects become viable as debt costs shrink.

- Deals accelerate: Buyers and sellers close valuation gaps and restart developments.

- Design firms get busier: The ABI turns positive, with construction starts following 9–12 months later.

- Competition tightens: As labor and material capacity fill, margins narrow—making early positioning critical.

With both the Federal Reserve and Bank of Canada now easing policy, the baseline forecast calls for gradual expansion through 2026, led by industrial, healthcare, civic, education, and data center projects. Retail will follow tenant demand, and hospitality growth will remain market-specific.

How to Get Ahead of the Curve (and Your Competition)

When the market turns, timing is everything. The companies that know where and when new projects are breaking—and who to call first—will win and secure the most profitable partnerships.

That’s where Construct-A-Lead comes in:

- Access the newest commercial projects across the U.S. and Canada—including hard-to-find private developments.

- Every project includes key contacts like owners, architects, and general contractors—so you can connect early and build relationships that pay off.

- Receive a steady stream of verified project leads matched to your territory, trade, or vertical market.

Take Your Free Test Drive

Get full access to five live commercial projects—no credit card required. Be prepared for the next wave of opportunity before your competitors even know it’s coming.

STAY UP-TO-DATE!

Subscribe to receive our newsletters with insights and tips from industry experts.

RECENT ARTICLES

How to Access Online Building Reports for Commercial Projects

Finding construction data is no longer the hard part. The real challenge is knowing where to look first, how much confidence to place in what you find, and how to turn fragmented information into decisions that hold up under schedule, budget, and regulatory pressure.

Building Opportunity: Why Verified Leads Matter More Than Ever in a Changing Construction Market

Interest rates are finally easing—slowly, but meaningfully—and that’s creating new momentum across the commercial construction industry.

The Construction Turning Point: What You Need to Know About Rate Cuts and 2026 Growth

Interest rates are finally easing—slowly, but meaningfully—and that’s creating new momentum across the commercial construction industry.