The United States has long grappled with housing affordability issues, driven in part by an inadequate housing supply. According to Freddie Mac, the nation faces a staggering 3.8 million unit shortage of housing. This problem was exacerbated by the COVID-19 pandemic, which led to a drop in housing inventory to record lows in 2020. As remote work and learning became the norm, the demand for larger, single-family homes surged, intensifying competition among buyers and renters. Supply chain challenges and labor shortages further hindered the construction of new housing units, as building permits and housing starts outpaced completions.

Now, with higher interest rates in play, building permits have reverted to 2019 levels.

However, amidst these challenges, there is a ray of hope: an uptick in planned multi-family housing construction. Multi-family housing, with its ability to increase housing density and availability, has gained prominence in both urban and suburban areas. It is seen as a more efficient and cost-effective solution compared to single-family homes, aligning well with the renewed interest in denser living arrangements closer to work and social attractions.

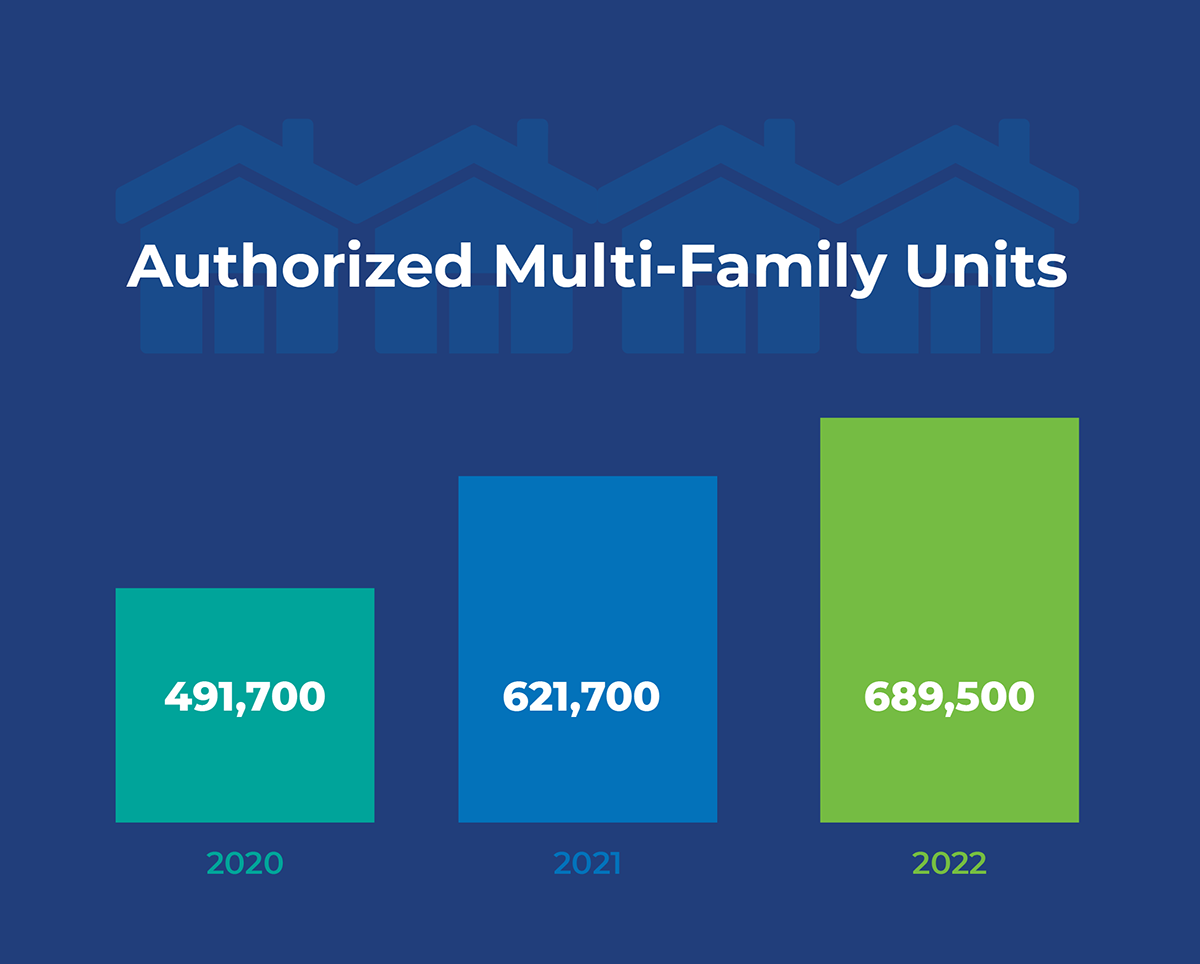

In 2021, there was a notable resurgence as the total number of authorized multi-family units jumped from 491,700 to 621,700, increasing the share of multi-family units authorized from 33.4% to 35.8%. The trend continued into 2022, with the authorization of multi-family units reaching 689,500. Simultaneously, the number of authorized single-family units experienced its first decline since 2011. This shift marked a significant milestone, with multi-family buildings accounting for 41.4% of new housing, the highest level seen since 1985.

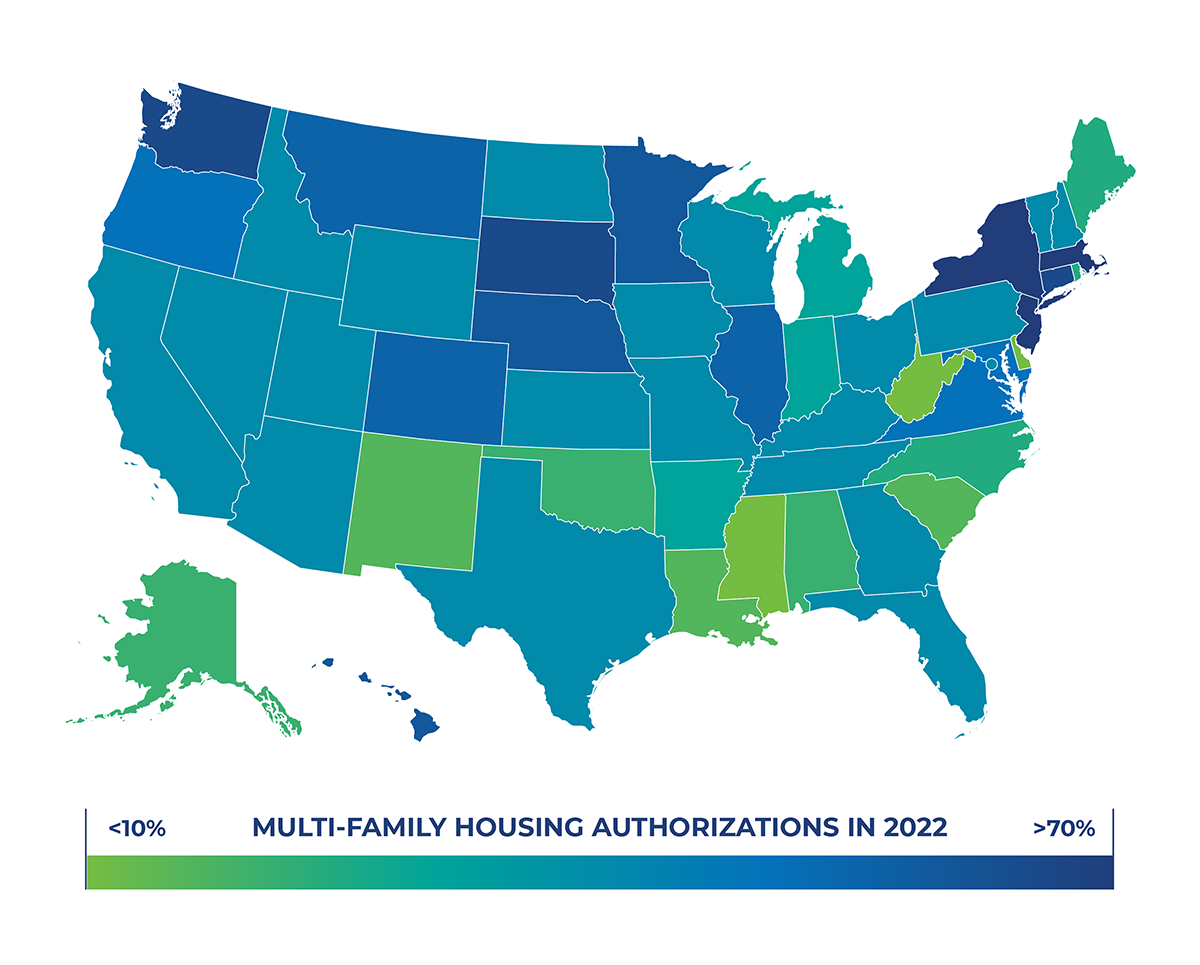

Multi-family housing is instrumental in boosting housing availability, particularly in states with substantial urban populations. Nationally, approximately 28% of the current housing stock falls under the multi-family category, though regional variations exist. New York State leads the way with 52.5% of homes classified as multi-family, followed by Massachusetts (43.1%), Rhode Island (38.6%), Hawaii (36.4%), and New Jersey (36.0%). Conversely, less densely populated states in the South, Midwest, and Mountain West traditionally have lower concentrations of multi-family housing.

The Future: Surprising Trends

Analyzing the data for 2022 reveals intriguing trends. States already accustomed to multi-family housing, such as New York, Massachusetts, and New Jersey, witnessed significant upticks in authorizations, surpassing 60% of the total in these states, with New York leading at nearly 74%. Moreover, in nearly all states, the percentage of new housing units categorized as multi-family exceeded that of the existing housing stock.

One of the most remarkable developments is the surge in multi-family home construction in unexpected regions. Midwestern and Western states, which have typically maintained average or below-average concentrations of multi-family housing, now boast proportions of newly authorized multi-family units exceeding 50%. States like South Dakota, Washington, Minnesota, Nebraska, Colorado, and Montana have all crossed this threshold.

Local trends echo these patterns, with densely populated coastal cities and key Midwest and Western areas leading the charge in multi-family development. There are exceptions in Florida, Texas, and Georgia, but generally, southern cities report the lowest rates of new multi-family housing due to lower demand and home prices compared to other regions.

Bottom States

- 1

Missisippi – 7.5%

- 2

Delaware – 8.8%

- 3

West Virginia – 13.5%

- 4

Louisiana – 15.6%

- 5

South Carolina – 17.4%

- 6

New Mexico – 17.9%

- 7

Alabama – 18.1%

- 8

Alaska – 18.5%

- 9

Oklahoma – 20.3%

- 10

North Carolina – 29.0%

- 11

Rhode Island – 30.1%

- 12

Maine – 30.8%

- 13

Michigan – 31.7%

- 14

Indiana – 33.9%

- 15

Arkansas – 34.1%

Top States

- 1

New York – 73.7%

- 2

Massachussetts – 65.0%

- 3

New Jersey – 64.3%

- 4

South Dakota – 58.4%

- 5

Washington – 58.4%

- 6

Connecticut – 56.8%

- 7

Minnesota – 56.7%

- 8

Nebraska – 54.4%

- 9

Hawaii – 53.3%

- 10

Illinois – 52.5%

- 11

Colorado – 51.4%

- 12

Montana – 50.6%

- 13

Maryland – 49.6%

- 14

Oregon – 49.3%

- 15

Virginia – 46.8%

Construct-A-Lead: Empowering Commercial Contractors

In this evolving landscape, staying updated with construction trends and project opportunities is vital for commercial contractors. Construct-A-Lead’s software platform plays a pivotal role in helping contractors identify and pursue multi-family housing projects across the United States. By providing comprehensive data and project insights, Construct-A-Lead empowers contractors to build their project pipeline, adapt to changing market dynamics, and contribute to meeting the growing demand for multi-family housing.

The surge in multi-family housing construction offers a promising solution to the ongoing housing supply crisis in the United States. As the market continues to evolve, commercial contractors can rely on tools like Construct-A-Lead to navigate the changing landscape, find new opportunities, and play a vital role in addressing the nation’s housing needs. With multi-family housing on the rise, the construction industry is poised to make a meaningful impact on housing availability and affordability.

STAY UP-TO-DATE!

Subscribe to receive our newsletters with insights and tips from industry experts.

RECENT ARTICLES

The Ultimate Guide to Finding Large Commercial Construction Project Leads (2025 Edition)

This 2025 guide breaks down the most effective strategies, tools, and platforms for finding commercial construction project leads. Whether you’re looking to diversify your project portfolio, expand into new regions, or scale your operations, this resource is your starting point.

Why Use a Construction Lead Generation Service? (Benefits for Large-Scale Projects)

If you're a contractor, supplier, or service provider looking to land more large-scale commercial jobs, chances are you've tried everything—referrals, bid portals, cold calls, and even LinkedIn messages. While those tactics still hold some value, they’re no longer enough to compete at scale.

Optimizing Your Online Presence to Attract Commercial Construction Leads

Whether you're a general contractor, subcontractor, supplier, or service provider, your online presence plays a critical role in attracting large commercial construction leads.